What Moving Average Says About Market Trends?

Moving averages are handy tools for decoding market trends but beginners often scratch their heads trying to figure out what they really mean and what they’re good for. This article explains what moving averages are, how they work behind the scenes and the clues they can give about market behavior.

Understanding the Basics of a Moving Average

A moving average is a handy statistical tool that smooths out short-term bumps and jolts in price data by averaging values over a set period. As fresh data rolls in it updates on the fly and helps cut through daily noise and wild swings to reveal the market’s true trend.

- A moving average takes the average price of an asset over a certain period and helps smooth out ups and downs that can make your head spin.

- It’s a handy tool for traders and investors, letting them cut through short-term noise to catch a glimpse of the market’s overall direction.

- Rather than getting tangled in raw price data, a moving average highlights the average trend. It offers a clearer picture of what’s really going on beneath the surface.

- By smoothing things out it dials down the impact of sudden spikes or sharp drops, making trend analysis easier and more reliable.

Common Types of Moving Averages a quick look at the usual suspects

There are two primary types of moving averages: the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). The SMA is a steady reliable friend who averages prices over a set period and smooths out the bumps. The EMA is more lively and gives recent prices extra attention.

| Moving Average Type | Calculation Method | Responsiveness to Price Changes | Typical Use Cases |

|---|---|---|---|

| Simple Moving Average (SMA) | Calculates the straightforward arithmetic mean of closing prices over a specified period, nothing fancy here | Tends to react slowly, showing less sensitivity to recent price wiggles and sudden moves | Often the go-to choice for spotting long-term trends and smoothing out noisy data, kind of like the dependable friend who’s always calm |

| Exponential Moving Average (EMA) | A weighted average that gives more oomph to recent prices, making sure the freshest data carries more weight | Responds faster, capturing recent price jumps and dips in a heartbeat | Commonly favored for short-term trend spotting and timely trading signals when speed really matters |

| Weighted Moving Average (WMA) | Assigns different weights to prices depending on their spot in the dataset, so newer points get more say | Strikes a middle ground with moderate speed, balancing quick reactions and cutting through the noise | Great for detailed trend analysis where some data points basically get VIP treatment |

| Hull Moving Average (HMA) | A clever weighted average crafted to chop lag and smooth out noise like a pro chef dicing onions | Very responsive and silky smooth, perfect for short-term trend hunting | Loved by advanced traders who want their moving averages to be both fast and smooth without the usual fuss |

Traders often lean towards the SMA since it is straightforward and makes spotting longer-term trends a bit more intuitive. Meanwhile, the EMA usually wins favor with those who prefer to jump on recent price moves a little quicker.

Understanding What Moving Averages Really Tell Us About Market Trends

Moving averages provide handy clues about what is going on in the market by highlighting the trend's direction and giving you a feel for how strong that trend might be. They sometimes hint at potential reversals. When prices generally edge upwards we call it a bullish trend, and when prices fall it signals bearish trends.

- Moving averages are very useful for confirming whether a market is bullish and trending upward or bearish and heading downward.

- When a short-term moving average crosses above a longer-term one, it often signals a potential buy. Traders refer to this as a bullish crossover, but it does not guarantee success.

- The gap between the price and the moving average provides a rough idea of the trend's strength. Think of it as a subtle hint rather than a sure prediction.

- Moving averages often act like moving targets themselves. They serve as dynamic support or resistance levels that price tends to respect during trending moves.

How Moving Average Crossovers Can Make Spotting Trends a Bit Easier

Moving average crossovers occur when a short-term average crosses over a longer-term average often pointing to a shift in momentum. One classic example is the Golden Cross which usually hints at bullish momentum when the short average climbs above the long average. On the flip side there’s the Death Cross which generally signals bearish momentum as the short average slips below the longer one.

- A crossover happens when two moving averages intersect on the price chart hinting at a possible shift in the trend—kind of like a subtle nudge from the market.

- This dance typically involves a short-term average like the 50-day crossing paths with a longer-term average such as the 200-day.

- When the short-term average moves above the longer one we call it a bullish crossover or the Golden Cross. It signals growing buying interest and the potential for prices to head north.

- On the flip side a bearish crossover, known as the Death Cross, shows mounting selling pressure and the likelihood of the trend taking a dive.

Moving average crossovers often act like traffic signals on the trading road, signaling when it could be a smart move to jump in and when it’s probably best to pump the brakes and hold back a bit.

Applying Moving Averages with Real-World Examples (Because Theory Alone Will not Cut It)

Traders often lean on the trusty 50-day and 200-day moving averages when they are trying to figure out whether to buy or sell assets like stocks or cryptocurrencies. You will usually see these averages plotted right on price charts, where individuals keep a sharp eye on how prices dance around them.

Pick the asset and timeframe you want to dig into.

Crunch the numbers to find the moving average for your chosen periods, such as the 50-day and 200-day simple moving averages. 3. Keep an eye on how the current price plays along with these moving averages to get a good feel for the trend.

Watch out for crossover moments between the shorter and longer moving averages.

Mix these nuggets of insight with other data you trust to help guide your call on whether it’s time to buy, hold, or sell.

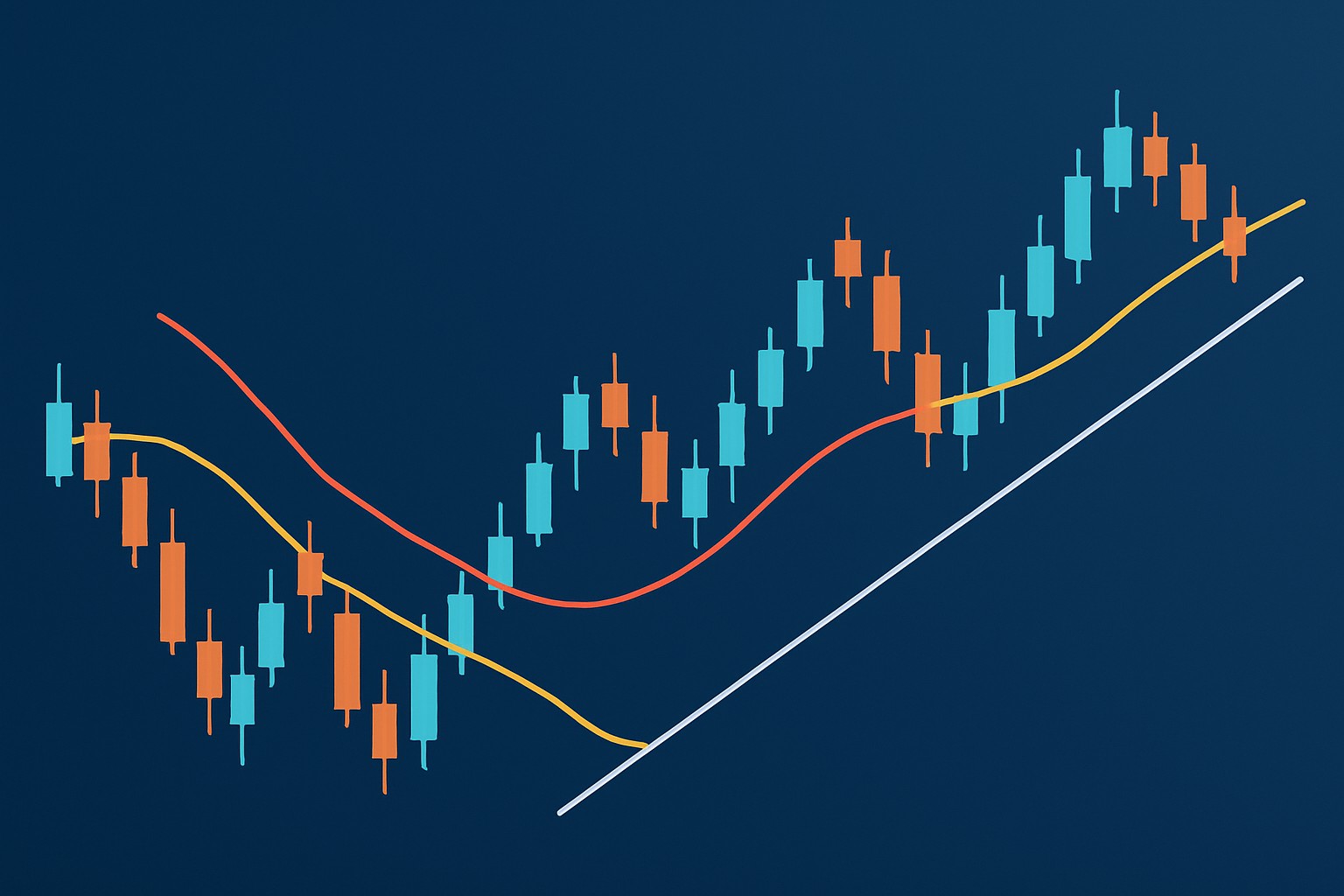

A line chart of a stock price including plotted 50-day and 200-day moving averages, highlighting a Golden Cross and a Death Cross.

Using moving averages alongside volume indicators or momentum oscillators usually leads to more reliable trend signals. If you want a complete guide about moving average, take a look at IAO Alliance.

What You Might Not Realize

Many beginners tend to believe moving averages can actually predict future prices. The reality is less exciting—they are lagging indicators that only confirm trends once they are already in motion, not before. Because of this quirk, leaning solely on moving averages can lead to delays or misleading signals especially when the market moves sideways.

- Moving averages tend to lag behind the action since they react to past price moves instead of predicting the future.

- They shine brightest when used to confirm trends that have started rather than being the lone star in your prediction toolkit.

- In choppy sideways markets moving averages can throw out misleading crossover signals like false alarms at times.

- Context is king here — the smartest move is to pair moving averages with other technical or fundamental indicators to help you make decisions that feel more grounded and less like a shot in the dark.

Really get the most out of moving averages by not putting all your eggs in one basket. Instead, pair their signals with volume analysis or momentum indicators and a good grasp of market fundamentals.

Picking the Best Moving Average Settings A Handy Guide

Choosing the right moving average settings usually boils down to a few important things: your analysis timeframe, how jumpy or stable the asset tends to be and what you’re hoping to get out of your trading. Shorter moving averages often jump the gun and react quicker but watch out—they can throw off false alarms now and then. On the flip side, longer averages offer a steadier hand though they’re a bit slower to pick up the pace.

- React pretty quickly to price changes but they can trigger plenty of false alarms along the way.

- Helps you cut through the market noise while introducing some lag so they are the preferred choice when you are looking for the long-term trends that really matter.

- Plays a big role in your decision here because more volatile assets usually require longer periods to tame those pesky whipsaws.

- Day traders usually prefer shorter periods for a nimble edge and investors tend to stick with longer ones to keep things steady.

Useful Links

- Investopedia - Your Go-To Spot for Reliable Financial Education and Market Insights

- Bloomberg Markets - Keeping You Up to Speed with the Latest Financial News and Data

- TradingView - Slick Charting Tools and Sharp Technical Analysis for the Savvy Trader

- CME Group - Deep Dives into Market Insights and Thoughtful Research